In September 2020 Vendavo and Copperberg conducted a survey in order to understand the direction of aftermarket trends following the unprecedented global disruption. The results received showed that many companies responded to the pandemic in a similar manner – by trying to change their business models in order to adapt. For many, that meant cutting expenses and putting the servitization journey on hold.

Author Iva Danilovic | Copperberg

Although the aftermarket services showed to be a stable source of profit, about 70% of companies are still waiting for the right momentum to deep dive into transformation. Kalle Aerikkala, Vendavo Senior Consultant, and Thomas Igou, Head of Content at Copperberg, discuss the key takeaways and future aftermarket trends that can drive companies forward.

Accessing digital readiness

Looking back to 2019, the biggest challenge for companies was to successfully integrate new technologies. Nowadays, one of the biggest challenges for companies is to design new adaptable business models. According to the 2020 Aftermarket Benchmark Survey, the companies are in search of new ways of functioning that can help push ahead with business in times of crisis.

When thinking about pillars of transformation, the strategy has the leading role in making all elements of the process work together successfully. Interestingly, a year before the crisis, 32% of companies claimed to have a clear digital strategy. When asked the same question this year, the results were down to 18%. This points out to the fact that COVID-19 made companies realize how digital-ready their companies really are, Thomas Igou notes.

From digital tools for internal communication to virtual tools used for servicing customers, the companies can now first handedly identify the missing pieces that could make their organizations more digitally mature.

According to the speakers of this year’s Copperberg Aftermarket Summit, servitization is more relevant than ever before. “Market research of leading industrial equipment manufacturing companies reveals that investment and focus on aftermarket services can boost company profitability” Kalle Aerikkala explains.

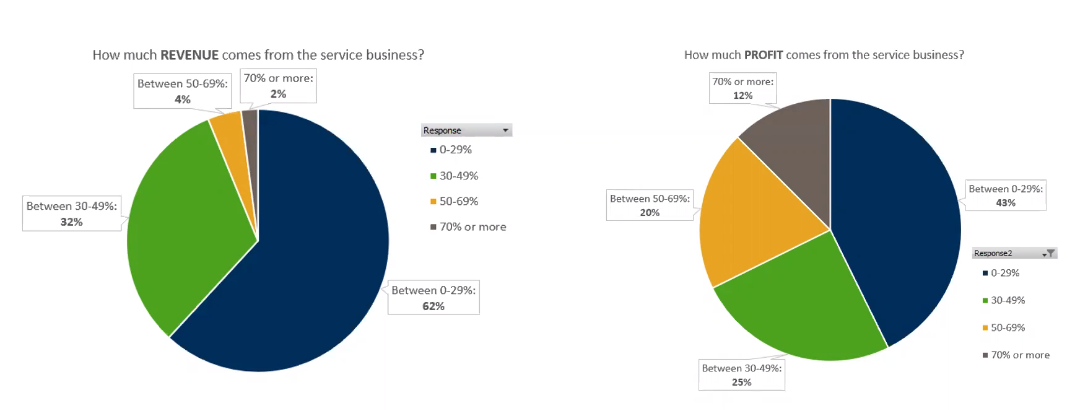

The survey results show that the profit share is consistently higher than the revenue share in the service business. “This shows that the aftermarket services are the most profitable business segment for the responded organizations, which is encouraging.”, Mr. Aerikkala points out. According to the survey results, he trusts that we are to witness more good results in the future as aftermarket services gain maturity and eventually take the leading role in organizations.

Survey results show a split in profit and revenue share in the service business.

Enabling businesses to grow

Historically, the aftermarket services in industrial settings have gone a long way. At first, the aftermarket services were denied as actual business segments especially within industrial settings. Even today, for some companies, aftermarket services are a necessity and serve only in brake/fix and warranty cases, and are not considered as a revenue and profit-generating businesses.

The survey results showed that there is a set of “blockers” that keep companies away from unlocking the potential of aftermarket services: 31% of respondents identified management support and missing skills as the main issue, while for 25% of companies designing new service models are the biggest challenge in the servitization journey. Additionally, COVID-19 negatively impacted aftermarket services, and 63% of companies reacted by introducing cost-cutting measures.

Nevertheless, cost-cutting measures are not a long term solution. “At some point the companies need to get things forward, savings alone will probably not achieve that”, Mr. Aerikkala concludes. He advises the companies that want to accelerate the transformation progress and invest in the aftermarket to focus on both organizational and technical aspects. There are three key elements to have in mind: Enablers (such as IoT and Sensors to name a few), the right plan, and an innovative business model.

According to Vendavo Senior Consultant, the critical step is to develop the organizational capabilities: Building a team and creating a platform. It is also a step where the corporation’s mindset is changing: At this point, a company is starting to perceive aftermarket service as the key value driver that delivers benefits for the whole company. This leads to the promotion of the aftermarket service business into a stand-alone entity, connected with the rest of the organization through technology.

Technologies indeed play a major role in enabling businesses to grow. Today, technology investment plans usually include the plans for enabling remote diagnostics and artificial intelligence, and tailored e-commerce platforms. These investments are mostly focused on functional aspects such as commercial excellence, logistics, and creating new business models. Most importantly, investment in the aftermarket features leads to the functional platforms that can be used to navigate market volatility.

Drivers of competitive advantage

As previously mentioned, commercial excellence strategies can help companies to navigate in the conditions of increased global competition. The survey results showed that half of the responders still have one main pricing model and that 15% of organizations use only the cost-plus pricing model. This indicates room for improvement.

By implementing a broader pricing toolbox companies can answer more challenges such as different price levels in different markets. “It is not a rare case that a customer is well informed about the market offer, while the companies lack to understand customer value drivers“, Vendavo expert emphasizes.

Investing in customer satisfaction and delivering enhanced customer value can create a competitive advantage. Taking the voice of a customer into the picture when creating the services is very important for the company’s development:

“When defining the business model companies should start with the customer value proposition, then think about price, define the cost structure, resources, and processes to support them. This also includes setting the right price for various marketing segments while considering the delivered value and competitive alternatives“.

Marketing operations need to make sure that the prices strongly line with the customer value proposition, and that they are communicated with all customers. Lastly, the prices need to be explained to the sales teams which are the first to justify them in front of the customers.

Noteworthy, the main change related to pricing after the initial disruption is a shift to deeper collaboration. COVID 19 crisis has led the teams towards a more collaborative type of organizational functioning and enabled teams to deal with some underlying issues. In the world of aftermarket, that meant focusing on price differences issues and learning how to be more customer-focused.

In conclusion, the current state of aftermarket services is expected to witness higher growth. The companies willing to invest in new business models and aftermarket services can achieve competitive differentiation even in these turbulent times. Finally, the companies that invest in the transformation journey are rewarded with sustainable advantage – they gain organizational maturity that will be more than useful in the days that follow.