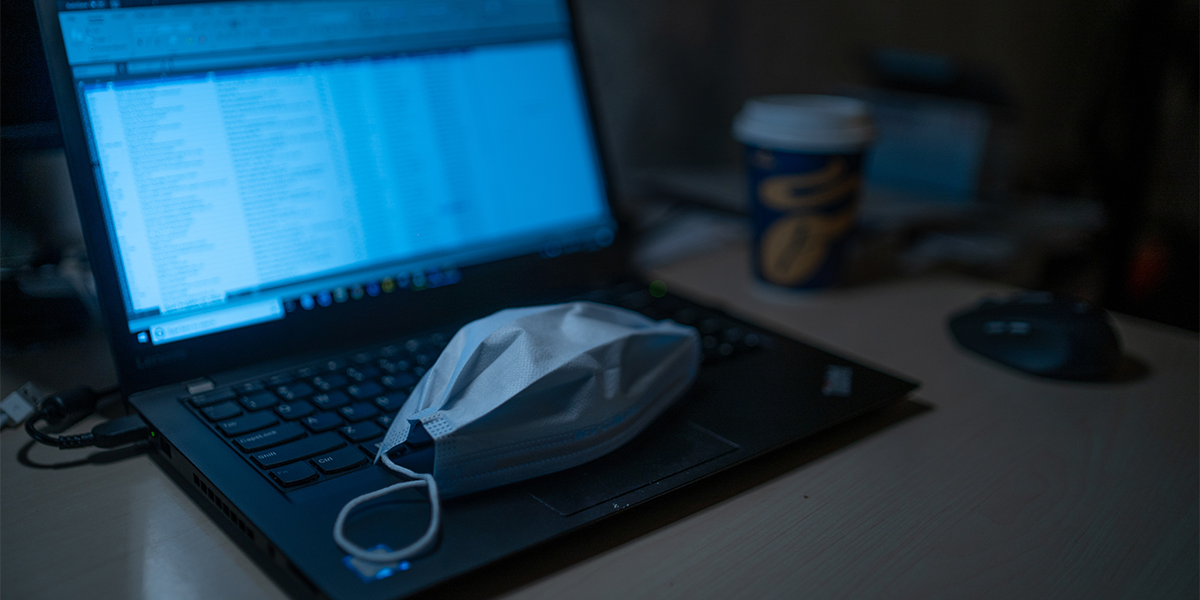

Just a few days ago, we posted on LinkedIn about the delays we were facing due to the Coronavirus outbreak. As it turns out, the scope of this issue has been severely understated, and may still get worse. Quarantines, and to some degree, the extended Lunar New Year holiday, have left Chinese factories trailing behind in production, so much so that certain industries expect up to 50% plunges in sales in Q1.

Author Adrian Cirlig | Copperberg

The perfect (production) storm

Given that China is the center of the electronics industry’s supply chain, it comes as no surprise that several major tech companies, including Apple, Google, Huawei, Samsung announced earlier this month they would temporarily shut down all manufacturing factories. In most cases, the initial plan was for production to resume on Monday, February 10, but according to the Nikkei Asian Review, these plans have been called off.

After conducting on-site inspections, public health experts have informed Foxconn, a key iPhone supplier, that its factories face a “high risk of Coronavirus infection”. According to the Nikkei reporters, no one wants to bear the responsibility for restarting work at this critical moment. The local governments have been very strict, especially with labor-intensive environments such as factories, where there’s an even higher risk of contamination due to the density of workers and poor airflow.

China is essentially blocking Foxconn from reopening its Shenzhen plant, but the Taiwanese manufacturer received government approval on Monday to resume operations at a plant in Zhengzhou. In an effort to reopen the factories as soon as possible, Foxconn has taken aggressive measures to prevent the outbreak, including building its own production line for surgical masks. Taiwanese employees are also asked to sign consent forms before returning to mainland China.

In what has been a perfect (production) storm for Apple, this extended shutdown comes at a time when the iPhone 11 inventory is already running low. The tech giant’s most iconic product may face shipment delays or even postponed launch events. Analysts are already cutting the shipment forecast by 10%. Compal Electronics (iPad supplier) also postponed plans to resume operations from Monday to February 17.

Facebook is also preparing for delays for its Oculus Quest VR headset. The company has stopped taking new orders for its latest product. “Oculus Quest has been selling out in some regions due to high demand. That said, like other companies we’re expecting some additional impact to our hardware production due to the Coronavirus. We’re taking precautions to ensure the safety of our employees, manufacturing partners and customers, and are monitoring the situation closely. We are working to restore availability as soon as possible,” said the company in a statement to Android Central. The headset’s availability has been pushed back to March 10.

Electric vehicle maker Tesla postponed Model 3 deliveries by one week, while Chinese manufacturers Huawei, Xiaomi, and Oppo said manufacturing is running normally, though minor delays are likely.

The ripple effect

With the supply chain already disrupted, further delays may still develop and pile-up. Let’s take a look at two critical factors that could impact manufacturing even past this year’s holiday season:

- New products

Most of the companies discussed above have contingency plans in place – contracts with other suppliers that help cushion the impact of production-related incidents. The Chinese tech giants, for example, are able to guarantee effective manufacturing capacity thanks to overseas plants and second suppliers for key parts. Though produced at a slightly slower pace, they enable a similar output.

The more significant medium-long term impact will be felt in the design and prototyping process. Current and older line-ups are generally produced at the same time as new products through a series of well-structured stages, some of which require hands-on engineering support.

“Companies with a product in development, whether they’re in the prototyping stage or what’s called the NPI stage, they’re at risk for holidays 2020 because the schedules for holiday are already tight, and the schedules are already slipping because the factories aren’t open and the supply chains aren’t up and running,” Andre Neumann-Loreck, founder of On-Tap Consulting told CNBC.

- Manpower shortage

This may sneak-up on most companies. Many Chinese factory employees are temporary workers and typically live outside of urban areas, therefore travel frequently. Containing the coronavirus outbreak has proven to be challenging, to say the least, and usually, first measures focus on limiting travel and access. Factory staffing could impact production for months to come if not anticipated.

“The delays in reopening factories and the labor return time will not only affect shipments to stores, it will also affect the product launch times in the mid- and long-term,” Will Wong, an IDC analyst, said for Reuters.

All things considered, it’s not all doom and gloom. Some factories have reopened, and many manufacturers managed to limit delays. Immediate drastic measures coupled with backup plans for production disruptions, seem to yield the best results.